Anytime a Government announces a spending measure, tax cuts, subsidies, stimulus packages, wars etc the first question to ask is "How are they going to fund it?"

One logical way would be to cut spendings on one front to fund the new spendings or another way is to increase tax collection. There is a third way that countries like Zimbabwe practice, print money but the ensuing hyperinflation causes major havoc to the economy than the short term benefits. Besides, in most countries only the Central bank and not the Government can print money and more and more we see fairly independent Central banks.

So this leaves the Government one most obvious way, Deficit funding.

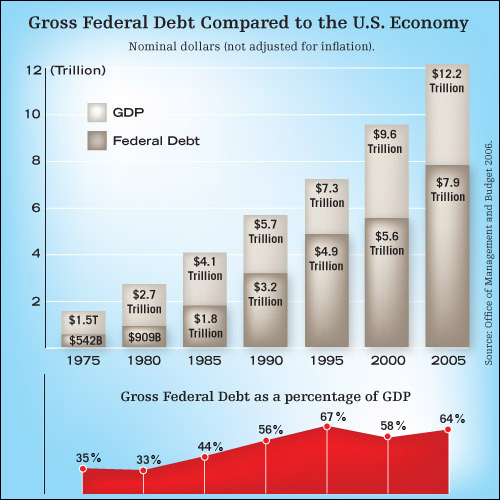

National Debt is what a Government or the nation has borrowed to fund its investments and operations. The debt, issued as bonds (e.g., T-bills) are either owned by the citizens or internationals (individuals, Governments and Central banks). For a common scale, the national debt is represented as a percentage of GDP.

The US economy by the recent estimate of GDP is $15 trillion. NPR reports on the recent move by Congress to raise the limit to $9 trillion. This is 60% of the GDP. (Image courtesy of NPR)

Why does the limit matter?

The debt is not free, there are interest payments and a considerable part of the national income goes towards debt servicing. With no limits on debt accruals a populist Government can run u debt to fund its pet projects. A nation's credit worthiness is also related to the debt it carries. So a nation with higher debt percentages may have to pay higher risk premiums on their interest rates. A large national debt also limits the Government's moves to stimulate the economy through deficit funding.

How does this compare to other countries?

China, the major trading partner of US has a national debt of 17%.

India has about 77%

The EU countries have a Stability and Growth pact that requires the national debt of member countries to be less than 60%. In practice however this is not strictly followed as some of the members like Italy have 75% debt.

The worst performer among the large economies is Japan with 160% national debt.

The question is, how far will the US treasury secretary and the Congress would go given the recessionary environment. McCain, Obama or Hillary are being handed a problem more difficult than the National Security issue.

No comments:

Post a Comment